Daniel Cohen - Homo Economicus, how addicted are we to economic growth?

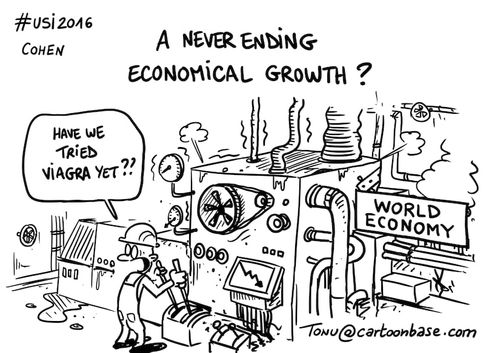

The second day of the conference was launched by the economist Daniel Cohen, giving a captivating talk around two questions: how addicted are we to economic growth, and why does it seem to be absent, or at least lagging behind progress in technology?

The absolute wealth of societies is now decorrelated from the relative wealth of individuals

At the beginning of the 1930s, economist John Maynard Keynes published the article Economic possibilities for our grandchildren, where he explains that the ongoing economic crisis will not last. He considers it a passing wave of pessimism. As he saw it, one hundred years ahead, society would be between four and eight times richer than in the 1930s. The economic problem would have disappeared, just as the problem of nutrition had at last disappeared from modern society. One century later, we can say that Keynes was not mistaken as to the rate of economic growth. With 2% growth per year, revenue has increased by a factor of 7!

And yet Keynes was mistaken as to how this wealth would be used: he underestimated the expansion capacities of the human appetite for material goods. For Daniel Cohen, the issue of buying power is clearly far from being resolved. The above paradox is widely known as the Easterlin paradox. It was formulated in 1974 and is to the modern world what Malthusian theory was prior to the demographic transition. The theorem states that whatever the gains in the level of wealth attained by a given society, there will be no tangible impact on the average standard of living in that society. Cohen invites the audience to examine the figures: in France, although per capita GDP has increased two-fold since the 1970s, well-being indicators have stagnated. In the US, they have continuously dropped.

Our constant addiction to economic growth is anchored in our individual desires

How can this paradox be explained? First of all it is important to remember that, beyond the subsistence level, human needs are never absolute but always relative. The strongest element of comparison is always "others". Losing access to the world of others is experienced as a form of dyssociality, of being exiled. When society progresses, each individual also feels the need to progress. As the American economist James Duesenberry puts it, American consumers need to "Keep up with the Joneses", i.e. be at the same consumption level as their neighbors.

This means that the need to accumulate goods is infinite.

Furthermore, compared to other species, nature has endowed humans with a remarkable capacity for adaptation. For humans, the norm tends to be what is around them. Only discrepancies are noticed, which explains the human propensity to get used to things, including a given level of wealth. Thus for both individuals and groups there is a need for a delta, for stimuli, for the pleasure of novelty. In consequence, what our modern societies hunger for is not wealth but economic growth. Growth is what makes it possible to exceed expectations, a bootstrap for all to improve their condition.

Growth is what has kept our modern societies ticking.

What will the 21st century bring: the return of growth or secular stagnation?

What would happen if growth disappeared altogether? Would our societies survive the resulting mass depression? Or would we meet Keynes's prediction, a few dozen years late, by doing away with the economic question? What should one think of perspectives for growth in our advanced societies? There are two clearly opposing camps trying to resolve this question.

In Daniel Cohen's terms, on one hand there are the believers, on the other the heretics. The former believe in the return of growth, the latter have resigned themselves. The former are partisans of Moore's law, which states that the capacity of processors will double every 18 months. According to them, we are entering a phase where the results will be spectacular. The effects of the law could be such that in thirty years we will be able to store all of an individual's intelligence on a thumb drive, and soon after that the intelligence of all of humanity. Robert Gordon leads the skeptics, who defend the theory of "secular stagnation". They base themselves on a simple observation, made by Nobel Prize laureate Robert Solow: "You can see the computer age everywhere but in the productivity statistics".

Indeed, despite advances in technology since the 1980s, in France the growth rate has never stopped diminishing, going from a plateau at 2% to stagnating at around 1%. The same is true in Japan, Germany and the US. In the US, for 90% of the population, there has been no growth. Increases in wealth have only reached the wealthiest. In fact, technology as a driving force is basically non existent for the middle classes.

Can digital technologies bring prosperity back?

How can this be explained? Initially, technology was in a relation of complementarity with work, leading to an overall increase in work productivity. Now however, the relation has gone from one of complementarity to one of substitution. Technologies are following their own trajectory, leaving human labor by the wayside. When speaking of polarization of the labor market, it is in the middle that technology has the highest impact. The only remaining jobs are at the top and bottom of the ladder, where digital doesn't yet have access, or potential gains in productivity are low. "The world is currently undergoing an extraordinary digital transformation, but so far the transformation is happening on its own" concludes Daniel Cohen.

More to read :